- Home

- The Problem

- About Simon Popple

- Free resources

- Contact

- The Squad List

- Let's get started!

- How I analyse investments

- Why Gold? Part I

- Why Gold? Part II

- Interviews with IG Index

- Your Situation

- Commodity prices

- An example

- Privacy Notice

- Different gold strategies

- Inflation

- Have I missed the boat?

- Do they know something we don't?

- Gold in a correction

- Video

- Gold and US Debt

- Three misconceptions about investing Gold

- Stressed about inflation

- Investing in Gold

Why commodities? An example - Gold mining stocks

The opportunity is incredibly simple. It's all about profiting from a tangible asset that's been around for thousands of years. Gold is recognised as being valuable anywhere in the world. We're not talking about pieces of paper or digital stuff.

Let me show you why it's so compelling.....

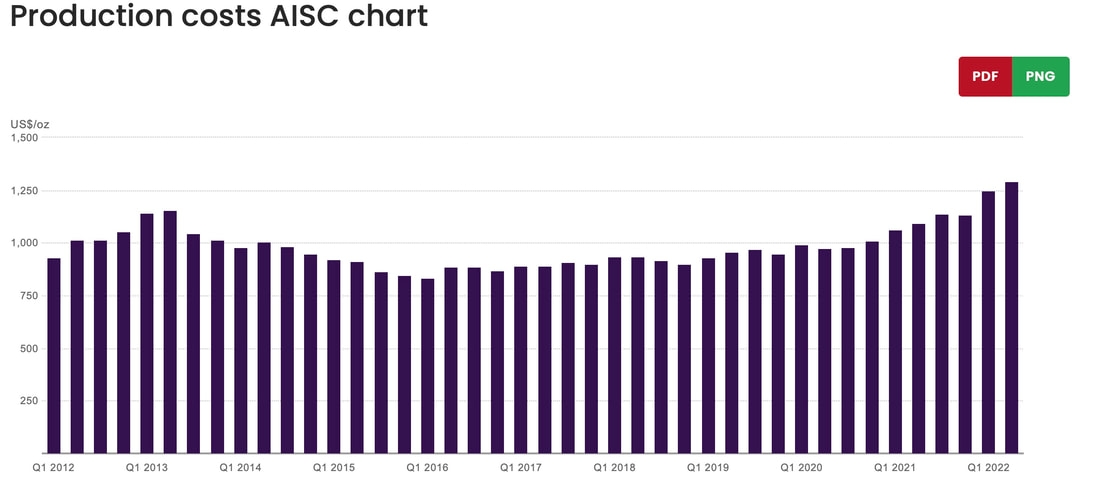

Firstly, take a look at the chart below that sets out the All-In Sustainable Cost ("AISC") for gold mining companies. Clearly this is an average, but if we were to assume an AISC of US$1,200 per ounce - I don't think that's unreasonable.

If we assume a gold price of US$1,650 per ounce, that's a profit to our mining company of US$450 per ounce.

Let's say the gold price moves up 20% to $1,980 per ounce. Although costs are likely to rise, they are unlikely to rise by the same amount. Let's say the AISC move up 10% to US$1,331 per ounce. This would provide a notional profit of US$649 per ounce. An increase of over 44%.

In this example, a 20% increase in the gold price has delivered over a 44% increase in profitability.

In today's market many producers are already generating a lot of cash. Not only that, but some have dividend policies whereby they distribute a good chunk of this to their shareholders. Providing a very nice income stream.

Following the Coronavirus, dividends have become increasingly difficult to find. But many gold miners are still paying theirs.

The opportunity is incredibly simple. It's all about profiting from a tangible asset that's been around for thousands of years. Gold is recognised as being valuable anywhere in the world. We're not talking about pieces of paper or digital stuff.

Let me show you why it's so compelling.....

Firstly, take a look at the chart below that sets out the All-In Sustainable Cost ("AISC") for gold mining companies. Clearly this is an average, but if we were to assume an AISC of US$1,200 per ounce - I don't think that's unreasonable.

If we assume a gold price of US$1,650 per ounce, that's a profit to our mining company of US$450 per ounce.

Let's say the gold price moves up 20% to $1,980 per ounce. Although costs are likely to rise, they are unlikely to rise by the same amount. Let's say the AISC move up 10% to US$1,331 per ounce. This would provide a notional profit of US$649 per ounce. An increase of over 44%.

In this example, a 20% increase in the gold price has delivered over a 44% increase in profitability.

In today's market many producers are already generating a lot of cash. Not only that, but some have dividend policies whereby they distribute a good chunk of this to their shareholders. Providing a very nice income stream.

Following the Coronavirus, dividends have become increasingly difficult to find. But many gold miners are still paying theirs.

Source: World Gold Council

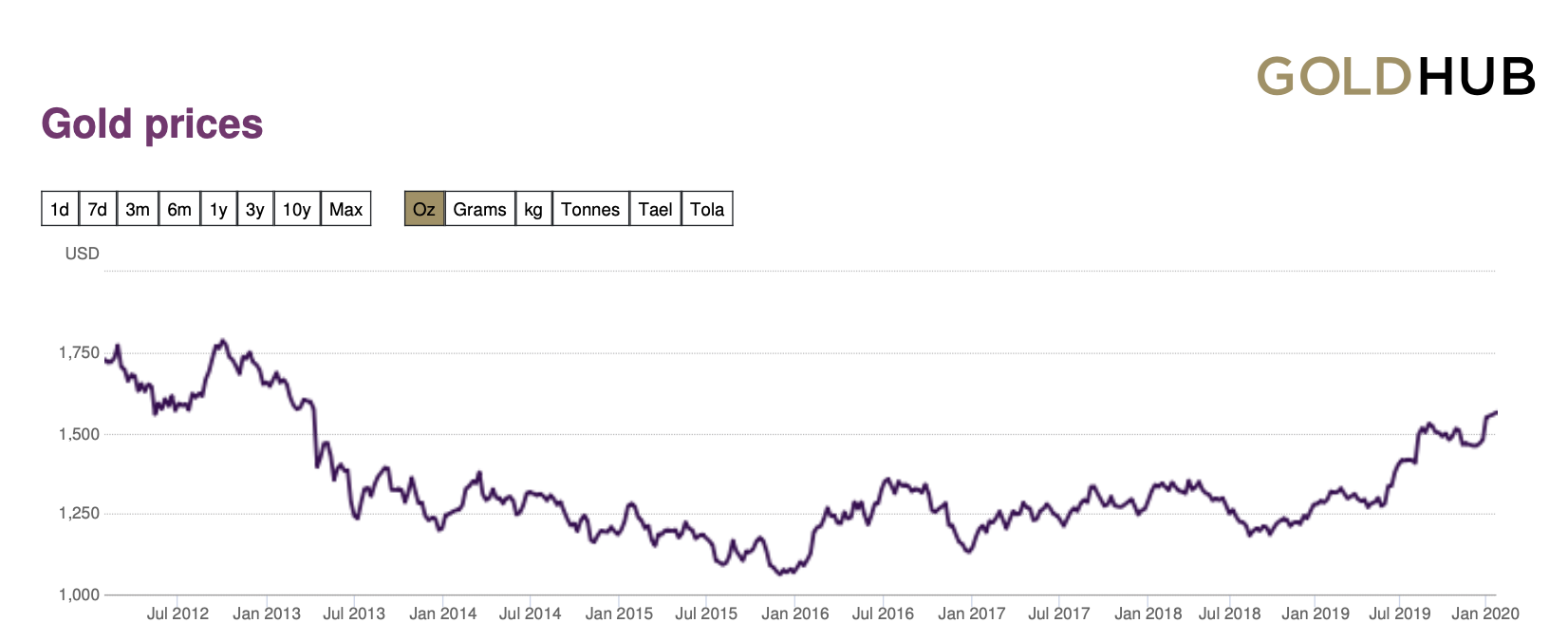

Here's the gold price:

Source: World Gold Council

Home |

THE PROBLEM |

ABOUT SIMON POPPLE |

FREE RESOURCES |

Contact |

Copyright © 2015

- Home

- The Problem

- About Simon Popple

- Free resources

- Contact

- The Squad List

- Let's get started!

- How I analyse investments

- Why Gold? Part I

- Why Gold? Part II

- Interviews with IG Index

- Your Situation

- Commodity prices

- An example

- Privacy Notice

- Different gold strategies

- Inflation

- Have I missed the boat?

- Do they know something we don't?

- Gold in a correction

- Video

- Gold and US Debt

- Three misconceptions about investing Gold

- Stressed about inflation

- Investing in Gold