- Home

- The Problem

- About Simon Popple

- Free resources

- Contact

- The Squad List

- Let's get started!

- How I analyse investments

- Why Gold? Part I

- Why Gold? Part II

- Interviews with IG Index

- Your Situation

- Commodity prices

- An example

- Privacy Notice

- Different gold strategies

- Inflation

- Have I missed the boat?

- Do they know something we don't?

- Gold in a correction

- Video

- Gold and US Debt

- Three misconceptions about investing Gold

- Stressed about inflation

- Investing in Gold

The problem

You've done nothing wrong. But you've done nothing.

Protect and Prosper

Listen to the news - there's a lot to worry about.

Debt, Brexit, trade wars....maybe real wars. Many things you can do nothing about, but there's one thing you can change.

I know you care....but you've done nothing to protect you and your family.

We live in very uncertain times. No-one can provide us with certainty, but doing nothing is NOT an option.

Imagine you were retiring tomorrow - what would happen? I won't retire for several years (I'm 56), but by the time I do, I want to make sure I've got enough money and it's invested in the right asset classes. You should do the same.

You need to do something......

You want to be in control, make decisions about your future. But you're running on auto-pilot. In fact, I can tell you what you're thinking about.....

After a good run, some of your shares are no longer paying dividend's, so you're thinking about switching into bonds. But hang on, there are mountains of debt out there. I think inflation is still rampant despite what the politicians tell me. Do you want to invest in something that loses money?

Ok, what about property? It's been very good to you.

Coronavirus got people thinking differently about property. Living close to the office used to be important, but is that about to change? We don't know. All I would say is that with property prices being where they are, it's not a market I'd be thinking about right now. I like to look at cycles and buying now does not look like a smart move to me.

I should add that with my own house, I'm already massively exposed to the property market. You're probably the same.

Perhaps you've been lucky and cashed out of some investments, but do you really want all of this money sitting in your bank account - only £85,000 is protected.....

As a matter of interest, if you ever had to use this insurance....what do you think £85,000 would be worth?

What happens if inflation obliterates your savings - your pension? Even worse, what happens if there's a default?

What would you live on?

Does it affect me?

Yes

You need to do something. You can't predict the future. But you CAN prepare - prevention is better than the cure.

The International monetary system runs on trust. Right now, that seems to be in short supply....cracks are appearing:

1) The highest gold purchases by Central Banks since 1971 - what do they know that we don't? Take a look at the page on what Russia and China are doing (Do they know something we don't?)

2) Interest rates that don't seem to want to come down

3) Mountains of debt with billions being created "out of thin air" by the Central Banks

You can paper over the cracks.....but they're still there.

Most people do nothing until it's too late....DON'T be one of them. Like trying to get insurance AFTER the event. Insurance must always be bought before things happen!

What's the problem?

There are many - but let's just look at one

Debt is out of control

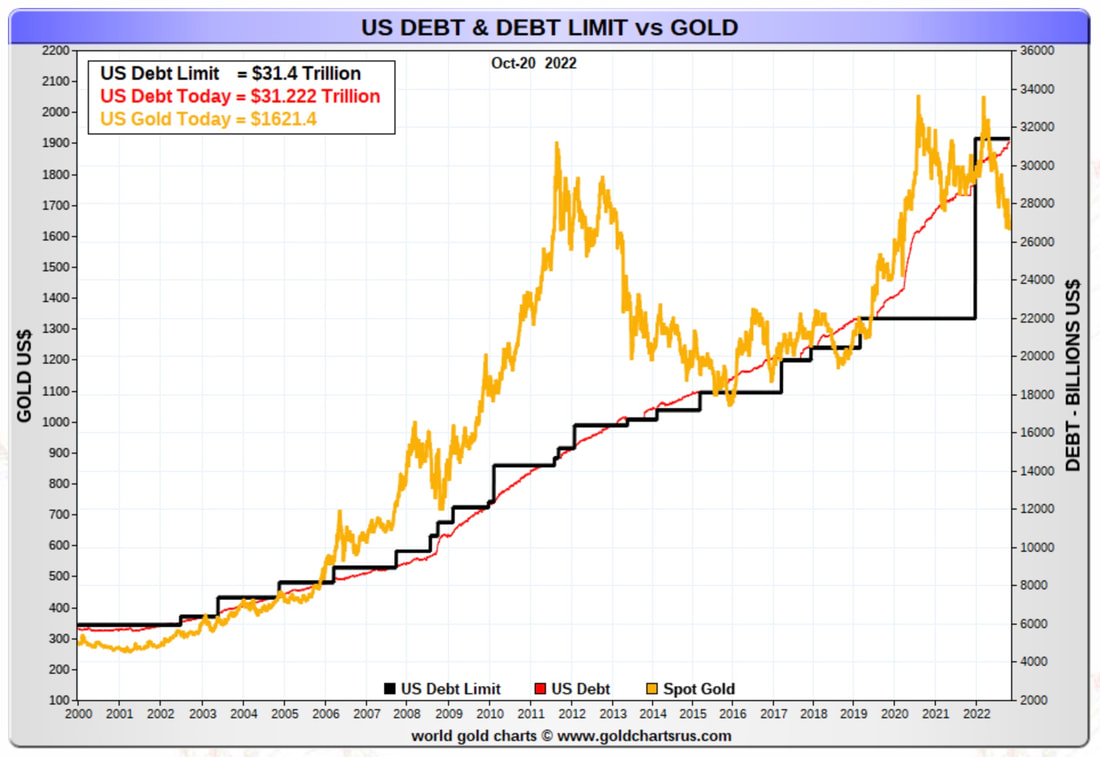

Take a look at this graph. It shows the relationship between US debt, the US debt limit and Gold. As you can see, US debt (the red line) is growing exponentially. If we were to revert to the previous relationship, either the debt would have to come down or the Gold price go up.

What do you think?

Listen to the news - there's a lot to worry about.

Debt, Brexit, trade wars....maybe real wars. Many things you can do nothing about, but there's one thing you can change.

I know you care....but you've done nothing to protect you and your family.

We live in very uncertain times. No-one can provide us with certainty, but doing nothing is NOT an option.

Imagine you were retiring tomorrow - what would happen? I won't retire for several years (I'm 56), but by the time I do, I want to make sure I've got enough money and it's invested in the right asset classes. You should do the same.

You need to do something......

You want to be in control, make decisions about your future. But you're running on auto-pilot. In fact, I can tell you what you're thinking about.....

After a good run, some of your shares are no longer paying dividend's, so you're thinking about switching into bonds. But hang on, there are mountains of debt out there. I think inflation is still rampant despite what the politicians tell me. Do you want to invest in something that loses money?

Ok, what about property? It's been very good to you.

Coronavirus got people thinking differently about property. Living close to the office used to be important, but is that about to change? We don't know. All I would say is that with property prices being where they are, it's not a market I'd be thinking about right now. I like to look at cycles and buying now does not look like a smart move to me.

I should add that with my own house, I'm already massively exposed to the property market. You're probably the same.

Perhaps you've been lucky and cashed out of some investments, but do you really want all of this money sitting in your bank account - only £85,000 is protected.....

As a matter of interest, if you ever had to use this insurance....what do you think £85,000 would be worth?

What happens if inflation obliterates your savings - your pension? Even worse, what happens if there's a default?

What would you live on?

Does it affect me?

Yes

You need to do something. You can't predict the future. But you CAN prepare - prevention is better than the cure.

The International monetary system runs on trust. Right now, that seems to be in short supply....cracks are appearing:

1) The highest gold purchases by Central Banks since 1971 - what do they know that we don't? Take a look at the page on what Russia and China are doing (Do they know something we don't?)

2) Interest rates that don't seem to want to come down

3) Mountains of debt with billions being created "out of thin air" by the Central Banks

You can paper over the cracks.....but they're still there.

Most people do nothing until it's too late....DON'T be one of them. Like trying to get insurance AFTER the event. Insurance must always be bought before things happen!

What's the problem?

There are many - but let's just look at one

Debt is out of control

Take a look at this graph. It shows the relationship between US debt, the US debt limit and Gold. As you can see, US debt (the red line) is growing exponentially. If we were to revert to the previous relationship, either the debt would have to come down or the Gold price go up.

What do you think?

If you want to do something about this then there are three options:

1) Get my Free fortnightly Newsletters

2) Buy my Book - The Beginners Guide to Invest in Gold

3) Buy the Squad List - I've done the heavy lifting and provided you with a list of companies that you can choose from.

Home |

THE PROBLEM |

ABOUT SIMON POPPLE |

FREE RESOURCES |

Contact |

Copyright © 2015

- Home

- The Problem

- About Simon Popple

- Free resources

- Contact

- The Squad List

- Let's get started!

- How I analyse investments

- Why Gold? Part I

- Why Gold? Part II

- Interviews with IG Index

- Your Situation

- Commodity prices

- An example

- Privacy Notice

- Different gold strategies

- Inflation

- Have I missed the boat?

- Do they know something we don't?

- Gold in a correction

- Video

- Gold and US Debt

- Three misconceptions about investing Gold

- Stressed about inflation

- Investing in Gold