- Home

- The Problem

- About Simon Popple

- Free resources

- Contact

- The Squad List

- Let's get started!

- How I analyse investments

- Why Gold? Part I

- Why Gold? Part II

- Interviews with IG Index

- Your Situation

- Commodity prices

- An example

- Privacy Notice

- Different gold strategies

- Inflation

- Have I missed the boat?

- Do they know something we don't?

- Gold in a correction

- Video

- Gold and US Debt

- Three misconceptions about investing Gold

- Stressed about inflation

- Investing in Gold

Your Situation

You will have...

Worked hard all your life, been smart and are now thinking of retiring or perhaps already retired. You're sensible - home and car insurance up to date - you don't want to take unnecessary risks.....

But you're worried about the future.

I want to help you enjoy your retirement, not spend days glued to your computer screen, worried about your investments.

You'd like to assume your financial adviser has "got it all in-hand" But have they? If you don't know - find out. Listen to their strategy. Do they have one? Does it make sense? Is their safe haven the debt market?

Given what you've just read - are you comfortable with that?

Right now I bet all your investments are in bonds, equities and property.

I want you to have a broader range of investments - which means you should include gold. It's been around for thousands of years, but very few have it as part of their portfolio.

.....but I think that's about to change.

What do you want for your future?

Financial peace of mind...

1) Protect what you have;

2) Some exposure to real "tangible" assets - that are not debt; and

3) Not have all your eggs in one basket

What do you need?

No-one can predict the future, but I can help you prepare.

Some things to think about.

1) Do you just want to try and protect what you already have. If that's the case you may want to allocate some of your portfolio to physical gold and perhaps some silver. Both have been good ways to protect purchasing power.

2) If you're looking for income, you may want to think about dividends.

3) Capital gains may be more your thing. Right now, I think there's a once in a lifetime opportunity on the table for gold investors - whatever your appetite for risk. If you want to take lower risk then buying the physical metal and larger mining companies may make sense. If you like higher risk, I can help guide you through the maze of the Junior Mining companies.

If you're looking for protection, income or capital gains.....we should be talking.

Why now?

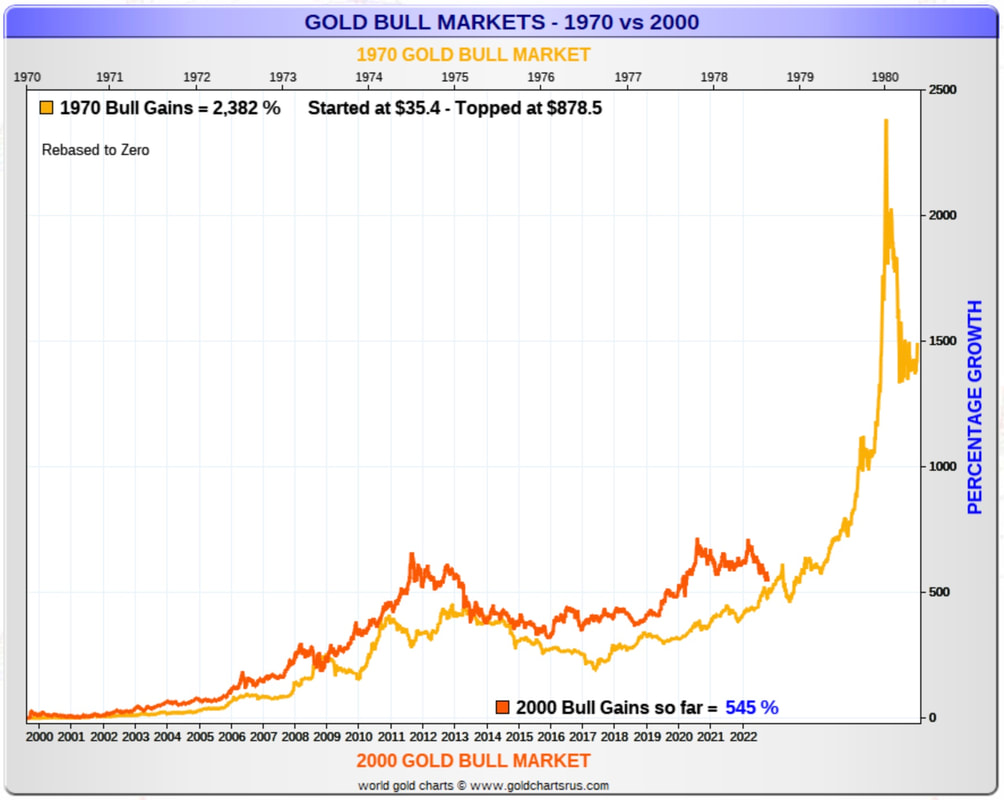

A picture paints a thousand words.

Here is a chart comparing the current gold bull market (red line) with the one in the 1970's (gold line). People who got in early in the 1970's could have made 10X, 50X even 100X their money investing in the right mining stocks. Others, wanting less risk, found exposure to physical gold a great way of protecting what they already had.

You're probably thinking these returns are a bit ridiculous. I know, I did when I was first introduced to the sector many years ago.

What I like about this opportunity is there's something for everyone. Whether you just want to protect your wealth or make money, it could be a great time to get involved in the sector.

Looking at where the red line is.....would it be ridiculous to have at least 1% of your wealth in gold?

Worked hard all your life, been smart and are now thinking of retiring or perhaps already retired. You're sensible - home and car insurance up to date - you don't want to take unnecessary risks.....

But you're worried about the future.

I want to help you enjoy your retirement, not spend days glued to your computer screen, worried about your investments.

You'd like to assume your financial adviser has "got it all in-hand" But have they? If you don't know - find out. Listen to their strategy. Do they have one? Does it make sense? Is their safe haven the debt market?

Given what you've just read - are you comfortable with that?

Right now I bet all your investments are in bonds, equities and property.

I want you to have a broader range of investments - which means you should include gold. It's been around for thousands of years, but very few have it as part of their portfolio.

.....but I think that's about to change.

What do you want for your future?

Financial peace of mind...

1) Protect what you have;

2) Some exposure to real "tangible" assets - that are not debt; and

3) Not have all your eggs in one basket

What do you need?

No-one can predict the future, but I can help you prepare.

Some things to think about.

1) Do you just want to try and protect what you already have. If that's the case you may want to allocate some of your portfolio to physical gold and perhaps some silver. Both have been good ways to protect purchasing power.

2) If you're looking for income, you may want to think about dividends.

3) Capital gains may be more your thing. Right now, I think there's a once in a lifetime opportunity on the table for gold investors - whatever your appetite for risk. If you want to take lower risk then buying the physical metal and larger mining companies may make sense. If you like higher risk, I can help guide you through the maze of the Junior Mining companies.

If you're looking for protection, income or capital gains.....we should be talking.

Why now?

A picture paints a thousand words.

Here is a chart comparing the current gold bull market (red line) with the one in the 1970's (gold line). People who got in early in the 1970's could have made 10X, 50X even 100X their money investing in the right mining stocks. Others, wanting less risk, found exposure to physical gold a great way of protecting what they already had.

You're probably thinking these returns are a bit ridiculous. I know, I did when I was first introduced to the sector many years ago.

What I like about this opportunity is there's something for everyone. Whether you just want to protect your wealth or make money, it could be a great time to get involved in the sector.

Looking at where the red line is.....would it be ridiculous to have at least 1% of your wealth in gold?

If you want to do something.....

....it makes sense to act before anything happens.....

Imagine an earthquake - everything's fine one minute - chaos the next. A financial crisis is just the same - a bubble in search of a pin.

Do something before it pops.

It boils down to trust...

Think about it....what's the only asset you can take anywhere in the World and it's considered valuable?

Anywhere.

The answer is Gold. You can't print it. It's trusted.

Gold is certainty in an uncertain world.

Even Bitcoin is depicted as a gold coin - but it's not. We all know that.

....it makes sense to act before anything happens.....

Imagine an earthquake - everything's fine one minute - chaos the next. A financial crisis is just the same - a bubble in search of a pin.

Do something before it pops.

It boils down to trust...

Think about it....what's the only asset you can take anywhere in the World and it's considered valuable?

Anywhere.

The answer is Gold. You can't print it. It's trusted.

Gold is certainty in an uncertain world.

Even Bitcoin is depicted as a gold coin - but it's not. We all know that.

Home |

THE PROBLEM |

ABOUT SIMON POPPLE |

FREE RESOURCES |

Contact |

Copyright © 2015

- Home

- The Problem

- About Simon Popple

- Free resources

- Contact

- The Squad List

- Let's get started!

- How I analyse investments

- Why Gold? Part I

- Why Gold? Part II

- Interviews with IG Index

- Your Situation

- Commodity prices

- An example

- Privacy Notice

- Different gold strategies

- Inflation

- Have I missed the boat?

- Do they know something we don't?

- Gold in a correction

- Video

- Gold and US Debt

- Three misconceptions about investing Gold

- Stressed about inflation

- Investing in Gold