- Home

- The Problem

- About Simon Popple

- Free resources

- Contact

- The Squad List

- Let's get started!

- How I analyse investments

- Why Gold? Part I

- Why Gold? Part II

- Interviews with IG Index

- Your Situation

- Commodity prices

- An example

- Privacy Notice

- Different gold strategies

- Inflation

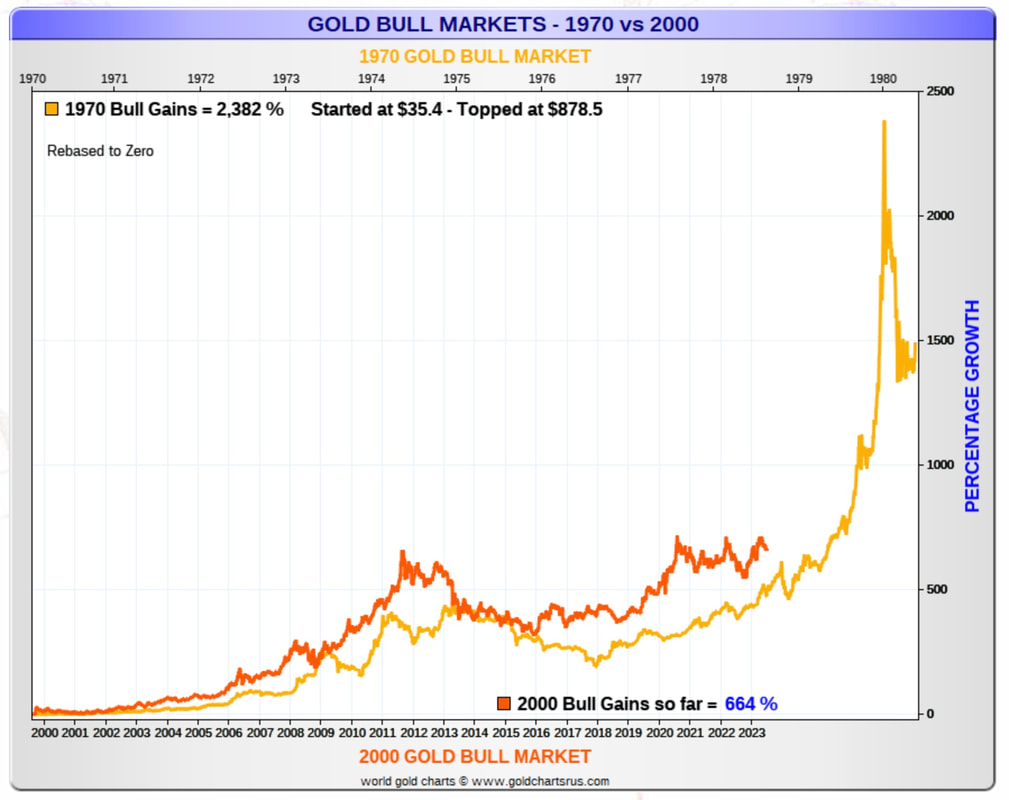

- Have I missed the boat?

- Do they know something we don't?

- Gold in a correction

- Video

- Gold and US Debt

- Three misconceptions about investing Gold

- Stressed about inflation

- Investing in Gold

Common sense is not so common - Voltaire

I like to start by looking at a wide range of investments - this is my thought process:

Bonds – inflation makes me nervous – I could end up losing purchasing power

Cryptos – they're relatively new, so don’t have the kind of track record I’m looking for

Equities – if we get a downturn, then earnings are likely to be squeezed, targets missed

Property – higher interest rates make me nervous

Cash – I like to have some, but I’d be worried about inflation eroding its value.

Bonds – inflation makes me nervous – I could end up losing purchasing power

Cryptos – they're relatively new, so don’t have the kind of track record I’m looking for

Equities – if we get a downturn, then earnings are likely to be squeezed, targets missed

Property – higher interest rates make me nervous

Cash – I like to have some, but I’d be worried about inflation eroding its value.

But there's a real buzz about Commodities....so I want to give them a closer look. Here is The Goldman Sachs Commodity Index.

But there are many different types of commodities....I can't invest in all of them...so I dig a bit deeper....how is gold shaping up?

Looks interesting eh?

This is very simplistic analysis - but I want to demonstrate two things.

1) Firstly, I have a system that points me in the direction of what asset class I should be looking at

2) Secondly, having identified the asset class, I've got another system for deciding where to invest.

Commodities, such as gold have been around for thousands of years - they've got form. With sky high debt and income difficult to come by, I'm sure you'll agree, it makes sense to have some in your portfolio.

I don't think it's ridiculous to have at least 1% of your investments in commodities such as gold. I bet you've got NONE.

Am I right?

Home |

THE PROBLEM |

ABOUT SIMON POPPLE |

FREE RESOURCES |

Contact |

Copyright © 2015

- Home

- The Problem

- About Simon Popple

- Free resources

- Contact

- The Squad List

- Let's get started!

- How I analyse investments

- Why Gold? Part I

- Why Gold? Part II

- Interviews with IG Index

- Your Situation

- Commodity prices

- An example

- Privacy Notice

- Different gold strategies

- Inflation

- Have I missed the boat?

- Do they know something we don't?

- Gold in a correction

- Video

- Gold and US Debt

- Three misconceptions about investing Gold

- Stressed about inflation

- Investing in Gold